David Stockman's Contra Corner

November 15, 2025

The more the nation's Fiscal Doomsday Machine cranks out ever higher spending and fatally rising public debt, the more we realize that the 16th Amendment was a monumental error.

In the end its ratification in 1913 may well turn out to be the inflection point at which American democracy and capitalist prosperity took a fatal turn toward ruination.

It need not have happened had the legislators of that era understood the long-term ramifications of making income taxation the revenue staple of democratic governance. In the first place, of course, any practical appreciation of human nature and the dynamics of democratic governance would tell you that ideally you should tax consumption, not income and wages, in order to defray the necessary costs of government.

That is to say, consumption and spending by the people does not require any inducements from the state-even as too much direct tax burden upon income and wages can most surely reduce the incentives for production, investment, risk-taking, innovation and enterprise.

Still, at least in theory a simple flat rate income tax at today's revenue levels would not be the end of the world in terms of its disincentive effects and restraint upon production and wealth creation. For instance, during 2024 the sum of employee compensation, interest and dividends and proprietors income was $21.3 trillion versus Federal income tax collections of $2.4 trillion.

So a uniform levy on all types of income at 11.4% would have generated the same Federal revenue as today's massive Federal income tax code. Accordingly, what would amount to little more than a one-tenth tithe to Uncle Sam would not unduly impair the essential ingredients of capitalist prosperity.

Unfortunately, as the income tax has evolved over the last 112 years Washington impinged ever more heavily upon the core supply-side ingredients of prosperity by taxing work, savings, risk-taking, invention, innovation and enterprise. But more crucially, passage of the income tax opened the door to drastic, politically-imposed redistribution of the wealth via progressive tax rates and unending loopholes and preferences for economic and social behavior that at any given moment a majority of the Congress decided to reward.

Not surprisingly, therefore, what had been 27 pages of statute in 1913 has now evolved into 2,650 pages in the IRS code and another 9,000 pages of implementing regulations. Self-evidently, nearly 12,000 pages of arbitrary and often opaque commands from Washington politicians and bureaucrats is the very opposite of the smooth, prosperity-generating workings of the unseen hand of the free market.

However, unlike the normal progressive critique claiming that the wealthy make out like bandits owing to this 12,000 page tangled web of loopholes, preferences and incentives, it transpires that more nearly the opposite is now the case: To wit, the actual, politically tortured income tax has essentially euthanized the middle class citizenry from the true, crushing burden of Big Government by concentrating the Federal tax burden at the very top of the economic ladder.

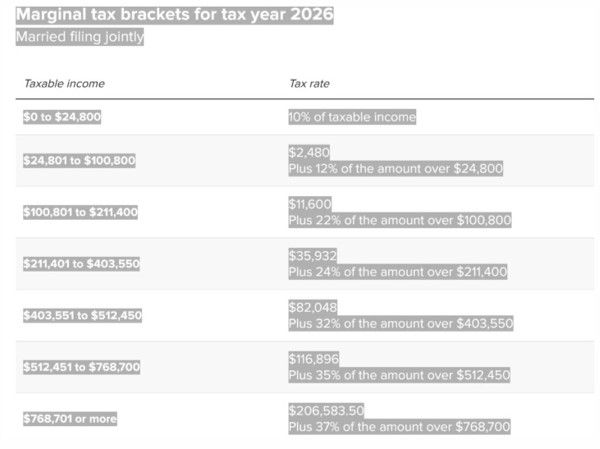

The recent release of the inflation-adjusted marginal tax brackets for 2026 provides a good reminder of how a bad idea-the progressive income tax-has been twisted, perverted and mutilated by Congress, especially since 1981. That is to say, after decades of tax cutting by the GOP we have now reached the point that the broad middle and even upper middle class no longer feels the pain of Federal taxation commensurate with Washington's bloated and growing claim on national income.

For the year just ended (FY 2025) the total Federal spending burden was a cool $7.0 trillion and amounted to 23.3% of GDP. In order to demonstrate this disconnect we have used the 2026 Federal income tax tables appended to the end of this post to calculate the share of household income taken by Federal income taxes and also by the employee share of payroll taxes at intervals from the median income household to the top 1%.

But first it should be noted that among the 154 million income tax filers in 2022, fully 31% or 48 million owed zero Federal income taxes due to the huge standard deduction of $32,200 for joint returns-plus another $2,200 of direct tax credits for each child 18 and under. And another 12 million paid less than $1,000 after all the current day deductions and credits.

In all, fully 122 million households pay a lesser percent of their gross income in Federal taxes than the 23.3% Federal spending share of national income. And for the vast bulk of the population the burden is far, far less.

This is possible, of course, only because 25% or more of Federal spending is being habitually borrowed from future generations (@ 6% of GDP deficits currently) and 65% of Federal income taxes are paid by the top 7% of households. That is to say, due to what has primarily been GOP tax policy over recent decades, the standard deduction and child tax credits have been pushed sky high while marginal rate brackets at the middle and lower end of the income ladder have been pushed very low consistent with supply-side doctrine.

Accordingly, middle class taxpayers have exceedingly low average tax rates relative to Uncle Sam's voracious helping of national income. For example, based on the new tax tables for 2026 (which reflect the changes in Trump's OBBBA) consider a two-earner household with two children under 18 years using the standard deduction and bringing home wage and salary income equal to the median household income of about $85,000.

That household would have $52,800 of taxable income after the standard deduction of $32,200 and would owe 10% on the first $24,800 of taxable income and a 12% marginal rate on the balance, thereby generating an income tax liability of $5,840 or just under 7% of gross income.

But the latter would be reduced by $4,400 owing to two child credits of $2,200 each. This means that the median household's net Federal income tax payment would amount to just $1,440!

So we do mean that GOP tax policy-low marginal rates for the supply-siders and a big standard deductions and generous child credits for the pro-family and natalist factions-has essentially exempted the middle class from Federal income taxes. After all, Uncle Sam's extraction of just 1.7% from an $85,000 income in 2026 would be roughly equivalent to a weekend at Disney World.

That's right. Aside from a few adjustments for single households and childless families that do not materially impact the analysis, the bottom line is this: Upwards of 66 million US households at the median income and below pay less than 2% in Federal income taxes to a Leviathan on the banks of the Potomac that devours nearly one-quarter of GDP.

To be sure, this two earner household would also pay a substantial amount to Uncle Sam for the employee share of OASDHI payroll taxes, which currently amounts to 7.65%. But unlike the case of income taxes, much of the public has been bamboozled into believing that Social Security withholding is a form of insurance premium for their retirement fund, and therefore is not quite as onerous as income taxes which go into the bottomless pit of the Federal budget.

That's nonsense, of course, because there are no real assets in the Social Security trust funds, just intra-governmental IOUs. These payroll levies are actually just a second layer of taxation on labor income. Still, even when you aggregate income and the employee share of payroll taxes for this $85,000 median income household, total Federal taxes under the 2026 schedule would come to $7,943 of just 9.3% of gross income.

Yet that's the true evil of the 16th Amendment as it has been twisted into a pretzel by modern GOP tax and fiscal policy. The 2026 tax schedule is telling households at the dead center of the income distribution that they can have 23.3% of GDP government for a 9.3% of income charge. Stated differently, they'll be getting Big Government on the Potomac on sale at 60% off.

Summary Of Federal Tax Burden At 1.0X Median Income or $85,000 Per Annum

- Gross wage & salary income: $85,000.

- Taxable Income after $32,200 standard deduction: $52,800.

- 10% liability on first $24,800 of taxable income: $2,480

- 12% marginal rate on the $28,000 balance of taxable income: $3,360.

- Total income tax liability: $5,840

- Average tax rate on gross income: 6.9%.

- Child tax credits: ($4,400).

- Net income tax payment:$1,440.

- Net payment as % of gross income: 1.7%.

- Payroll tax at 7.65%: $6,503.

- Total Federal Taxes paid: $7,943.

- Total taxes as % of gross income: 9.3%.

Moreover, the case above is not the half of it. As you move up the income ladder from the median, the same outcomes hold until you reach the tippy-top of the distribution.

For instance, in the case of the same two-earner, two-child standard deduction using household with a gross income at 2X the US median or $170,000, taxable income would be $137,880. So after paying 11.6% on the first $100,000 of taxable income it would pay at the 22% marginal bracket on the balance of $37,000.

Accordingly, its Federal income tax liability would total $19,740, less the $4,400 of child tax credits. Again, the actual income tax payment to Uncle Sam of $15,340 would compute to just 9.0% of gross income. That is to say, the current twisted Federal income tax would levy a single digit average rate on a household with $170,000 per year in wage and salary income!

Also, again, when you add the payroll tax, which is not capped until $176,000 for each of the two earners, the 7.65% levy would add another $13,005 of Federal extractions. Still, the combined income and payroll tax burden in this case would amount to $28,345 or 16.7% of gross income.

And, so yet again, no cigar. Even at 2X the median income, our representative wage earning family does not come close to carrying the 23.3% weight of what Milton Friedman properly called the true tax burden-that is, the pay me now or pay me latter spending share of national income.

Summary of Federal Tax Burden at 2X The Median Income or $170,000

- Gross wage & salary income: $170,000.

- Taxable income:$137,800.

- 11.5% tax liability on first $100,800 of taxable income: $11,600.

- 22% marginal rate on balance of $37,000: $8,140.

- Total income tax liability: $19,740.

- Average tax rate: 11.6%.

- Child tax credits: ($4,400).

- Net income tax payment: $15,340.

- Net income tax %: 9.0%.

- Payroll tax at 7.65%: $13,oo5.

- Total income and payroll tax: $28,345.

- Total Federal tax rate: 16.7%.

Thus, you must climb far up the income ladder to find a taxpayer that pays a 23.3% share of its gross income, under the stipulated but typical condition of two earners, two kids and the standard deduction. In fact, only when you get to 4X the median or $340,000 of gross income do you break-even.

In that case, the household's $307,800 of income after the standard deduction would fall in the 24% bracket. Accordingly, a liability of $35,932 on the first $211,400 (17%) and $23,146 on the balance (24%) would generate a blended liability of $54,668 after the child credits, or 16.1% on the gross income total. Only after adding in $26,010 of payroll taxes do you get total Federal tax payments of $80,678 or 23.7% of gross income.

In short, even when you set the marker to exclude 93% or 122 million of US households do you reach the point that a household is pulling a tax burden equal to the Friedmanite measure of the true Federal spending burden on national income, which currently stands at 23.3%.

So, yes, the current GOP-mutilated version of an inherently bad progressive income tax basically shields the overwhelming share of the voting public from anything that remotely resembles their pro rata share of Washington's spending spree.

No wonder they don't give a sh*t about runaway Federal spending and debt.

For want of doubt, we consider a final case that gets us to the boundary of the proverbial top 1%. At the present time the cut off line is $682,557 million for the top 1%, which in the most recent year (2022) consisted of 1.3 million households which paid fully 40.4% of Federal income taxes.

So consider a borderline $680,000 two-earner family which is a smidgen under the 1% boundary. Again, we stipulate two kids and for the sake of conservative bias we assume they too use the $32,200 standard deduction, although in all probability their tax accountants would find a lot more deductions from AGI (adjusted gross income) than $32,200. Still, on $647,600 of taxable income they would pay $116,896 (17.2%) on the first $512,450 of that amount and 35% marginal rate or $47,303 on the $135,150 balance.

That is to say, even at the edge of the 1% boundary, the marginal rate of 35% applies to only about 20% of the household's gross income. In total, therefore, the Federal income tax paid after the $4,400 of child tax credits would amount to $159,799 or 23.5% of gross income.

As a practical matter, we doubt that the near 1% household is fooled by the shibboleth that the payroll tax is really an insurance premium. But if they did it would amount to saying that even the near 1 percenter in this example is paying exactly the average rate (23.3%) for the entire Friedmanite toll on the overall US economy.

Is it any wonder, therefore, that Washington borrows and spends and runs up the national debt with reckless abandon?

Moreover, in the near 1 percenter case, the 6.2% payroll tax for OASDI would be capped at $376,000, assuming two equal earners, but the HI (Medicare hospital) tax at 1.45% is uncapped. So the total payroll extraction would be $31,684 or 4.66% of gross income. And altogether, income and payroll tax would amount to $191,483.

As it happens, that's 28.2% of gross household income or barely 500 basis points over the Friedman tax rate calculation for the entire Federal government. Needless to say, when the near 1% are barely pulling their weight on today's income, it is no wonder that by 2054 under current fiscal policy future taxpayers-some not even yet born-will be lugging $185 trillion of public debt.

Summary of Federal Tax Burden for the Near 1% or $680,000 of Gross Income

- Gross income: $680,000.

- Taxable income at standard deduction: $647,600.

- 22.8% tax on first $512,450: $116,896.

- 35% marginal rate on balance of $135,150: $47,303.

- Total income tax liability: $164,199.

- Tax liability rate on gross income: 24.2%.

- Net income tax after $4,440 child credits: $159,799.

- Net income tax % of gross income: 23.5%.

- 6.2% OASDI payroll tax on $352,000: $21,824.

- 1.45% HI tax on $680,000: $9,860.

- Total Federal tax payments: $191,483.

- Total tax % of gross income: 28.2%.

The truth of the matter is that the bad spawn of the 16th Amendment-the current mangled Federal income tax-is utterly incompatible with today's massive Welfare State and Warfare State spending enterprises.

The income tax places the overwhelming burden of tax collection on the top 1% and 5% of America's households, when only the pain of roughly proportionate taxation has a prayer of re-balancing the nation's fiscal politics as between the spenders and the payers.

Moreover, the payroll tax is almost as bad, given that it heavily taxes workers and employer labor costs at a time when the US has already priced itself out of the global markets owing to the pro-inflation policies of the Fed.

Accordingly, there is only one real solution that might stand a chance of stanching the nation's headlong rush to fiscal disaster, yet also not exacerbate the economic problem of high-cost labor in the US at all levels of the economy. To wit, replace both the income tax and the payroll tax with a national consumption tax, which would require $4.1 trillion of annual revenue replacement.

In addition, the Federal deficit posted at $2.4 trillion during FY 2025, which would require an additional $1.2 trillion revenue increase if the budget were to be balanced on a 50/50 basis between revenue increases and $1.2 trillion of spending cuts-with the latter distributed roughly evenly between defense cuts and entitlement reforms and means-testing.

In short, on an FY 2025 basis, a true escape from the disaster of the current income tax and payroll taxes would requires a consumption tax of about $5.3 trillion, which, in turn, would amount to about 25% of personal consumption expenditures (PCE) of $21.1 trillion during the fiscal year just completed.

To be sure, that sounds like a tall, if not impossible, order. But here's the thing: There is not a snowball's chance in the hot place that the current mangled income tax and economically oppressive payroll tax can be configured to bring the true Friedmanite cost of government to America's 133 million households in a manner that actually results in less spending and less build-up of the nation's runaway public debt.

In fact, the only why to tame the Leviathan on the Potomac is to insure that every time a household buys $400 of groceries or $400 of home decor items via Amazon or $400 of rides and refreshments at a theme park-they also pay an added $100 each time for Washington's Warfare State, Welfare State and endless pork barrel.

The public experiencing that pain over and over and over again is the only way that spending can be curtailed and fiscal catastrophe avoided.

Reprinted with permission from David Stockman's Contra Corner.