June 28, 2025

From July 1921 to July 1929 (8 years), politicians pushed us into Great Depression I by inflating money by 62%, From August 2008 through April 2022 (14 years), politicians pushed us into the current Great Depression II by inflating money by 303%.

Eventually we will get some politicians to do the right things, after they exhaust the alternatives.

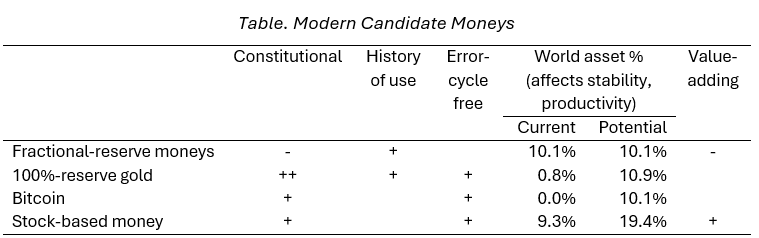

Background: constitutional, error-cycle free, world asset %, value-adding,

100%‑reserve gold constitutionality and history of use, stock-based money

Fractional-Reserve Moneys Consume Value

Under fractional-reserve gold standards after the Constitution was ratified, politicians granted bankers an unconstitutional privilege to create and loan out money that wasn't backed 100% by saved assets held in reserve.

Bankers would steadily create money, producing a boom. Producers would as a result make more unsustainable investments than usual, bringing a bust.

More people than usual wouldn't pay back loans, or people would run to withdraw their savings from banks, and banks would fail. This would rapidly destroy some of the created money.

With less money available for the same products, people would lower the prices of products and labor. Money would buy more. But borrowers would earn less, and loan contracts didn't adjust for this crisis deflation.

Politicians had let bankers inflate the money quantity, and this had changed the meaning of people's loan contracts. Politicians then helped bankers by enforcing those loan contracts on borrowers. By allowing money inflation and then enforcing the changed loan contracts, politicians unduly deprived borrowers of property.

Fractional-reserve dollars let crony-socialist politicians spend more, give cronies more favors, and rake in more donations. Politicians' booms bought votes, and politicians' busts enlarged governments.

While fractional reserves brought deprivations, gold standards did bring helpful natural deflation.

Gold mining slowly inflated the quantity of gold. But unlike banker-created money, mined gold never got destroyed. Also, the population and its productivity increased faster. The net result was that gold's purchasing power gradually increased.

People could save gold-backed money and later purchase more products. For many decades, this money increased in value 2.1% to 2.4% per year.

100%-Reserve Moneys Conserve Value

Going forward, congressmen and presidents could immediately require the Fed's people to make the money quantity constant. The money quantity wouldn't be increased by mining, but there would still be fractional reserves, so the money quantity would still change. And there would still be delays in collecting information and in making corrections, so the Fed's people would still control the money's quantity slowly, poorly, and unpredictably.

Instead, congressmen and presidents could immediately set the value of the dollar equivalent to a fixed weight of gold, determined by the price of gold at the time they make this change.

Or, state politicians could create gold moneys by offering gold warehousing and gold transaction processing. Transactional gold has been enacted in Arkansas, Florida, Louisiana, and Texas, and is being advanced in 21 more states. Private companies should also be free to compete separately to provide warehousing and transaction processing more efficiently.

Or politicians could immediately repeal legal tender laws, tax laws, and all other laws that interfere with using 100%-reserve moneys. Producers would then develop competing moneys.

100%-reserve gold will at last give people a constitutional money. People will no longer be forced to use a money that deprives them of property. Gold will even be suitable to constitutionally be coined and have a regulated weight.

100%-reserve gold worked well-free from fractional-reserve moneys' crisis-deflation liquidity crises-in the Dutch Republic from 1609 through the late 1770s. This good money helped the Dutch spread their political and economic practices to help free the English and then free the Americans.

100%-reserve moneys eliminate boom-bust government money error cycles: GME ("gimme") cycles. These moneys also increase in purchasing power. As Great Depression II continues and money inflation continues, moneys that eliminate error cycles and that increase in purchasing power will keep becoming more attractive.

Bitcoin as money would lack gold's history of use as an economywide money, gold's history of legal support, and the many instructive, case-specific lessons learned using gold. Using proven solutions like 100%-reserve gold greatly reduces risks.

Bitcoin would also start out behind gold in asset value.

Mainly, though, bitcoin as money would simply not bring advantages.

Stock-Based Money Will Add Value

Stock-based money not only will eliminate error cycles but also will increase in purchasing power the fastest.

Stocks are ownership of businesses. Since businesses produce the value that's used to purchase all other assets, stocks determine all assets' potential value.

Stocks will be bought with stock-based money. Stocks will no longer be bought with bank-created money that's created out of thin air and loaned out. Stocks will need to likewise no longer be allowed to be bought "on margin" using broker-created money, sometimes even using the same collateral for multiple investments.

Since buying stocks will then require investing savings, borrowers won't be able to take other investors on wild rides up and down. Investors won't be able to inflate stock prices as much. And when there are government pandemic responses, government wars, localized disasters, or isolated bankruptcies, investors will just lower stock prices to reflect the lower anticipated near-term profits.

If any nation's government people would limit their people's use of stock-based money, their people would attract much less investment than people elsewhere would attract. These government people would end up having limited their own power.

When money is made up of stocks, the proportion of world assets that people will keep invested in productive properties will be roughly doubled. This will usher in a new most-"golden" age.

Politicians have been using our money for themselves. We'll do far better when we use our money for ourselves.