March 27, 2023

Silicon Valley Bank Scapegoats

Please consider The Economy Changed, Regulators Didn't

On March 8, Silicon Valley Bank and Signature Bank were both, according to public disclosures, "well capitalized," the optimal level of health by federal regulatory standards. Days later, both failed."The question we were all asking ourselves over that first week was, 'How did this happen?'" Federal Reserve Chair Jerome Powell said Wednesday.

Banking regulators will spend months, if not years, getting to the bottom of what happened.

What none of the regulators or bankers anticipated was how fast depositors could flee, which appears to be a new reality in the age of smartphone apps and social media.

"The speed of the run...is very different from what we've seen in the past," Mr. Powell said Wednesday. "And it does kind of suggest that there's a need for possible regulatory and supervisory changes, just because supervision and regulation need to keep up with what's happening in the world."

FDIC officials are discussing how to manage public confidence as social media expands people's ability to "electronically panic," a person familiar with the talks said.

"The speed of the run...is very different from what we've seen in the past," Mr. Powell said Wednesday. "And it does kind of suggest that there's a need for possible regulatory and supervisory changes, just because supervision and regulation need to keep up with what's happening in the world."

Scapegoat Nonsense

The idea that the economy changed (it's always changing), and smart phones and social media are largely responsible for the failure of Silicon Valley Bank is a bunch of scapegoat nonsense.

OK, social media increased the speed at which SVB failed, but that has nothing to do with the cause of the failure.

Social media did increase the speed of the failure, but smart phones played no role at all. To initiate a wire from bank A to bank B requires an account at both banks. Whether this was done by computer, a regular land line, or a smart phone makes no difference in speed.

"Banking regulators will spend months, if not years, getting to the bottom of what happened."

What a hoot, yet I have no doubt it's true.

In Fed Q&A Jerome Powell Wonders "How Did Bank Failures Happen?"

"The question we are asking ourselves the first weekend is how did this all happen."

There is no need for a study. I outlined twelve reasons for the bank failures, none of which had anything to do with smart phones or the changing economy.

Please consider In Fed Q&A Jerome Powell Wonders "How Did Bank Failures Happen?"

How Did This Happen?

- The Fed held interest rates too low too long, once again.

- The Fed even wanted to make up for lack of prior inflation, initially welcoming the pickup of inflation.

- The Fed failed to understand how $9 trillion in QE would fan asset bubbles.

- The Fed failed to understand how three rounds of fiscal stimulus, the largest in history, would fan inflation.

- The Fed presidents believe in economic models such as inflation expectations that its own studies prove do not work.

- When inflation did pick up, the Fed kept insisting that inflation was transitory.

- Even when the Fed finally realized inflation was not transitory, it kept QE going until the bitter end, not wanting to disturb prior forward guidance.

- The San Francisco Fed, whose job it was to monitor Silicon Valley Bank (SVB) was asleep at the wheel.

- The Fed considers treasuries a risk-free asset, ignoring duration risk.

- The Fed ignored a record concentration of long-term treasury and mortgage assets at SVB despite understanding the interest rate risk of those assets.

- The Fed's forward guidance has been a disaster. It openly encouraged speculation.

- The Fed reduced reserve requirements on deposits to ZERO.

If you are looking for one item and one item only look at point 12. The reserve requirement on deposits is ZERO.

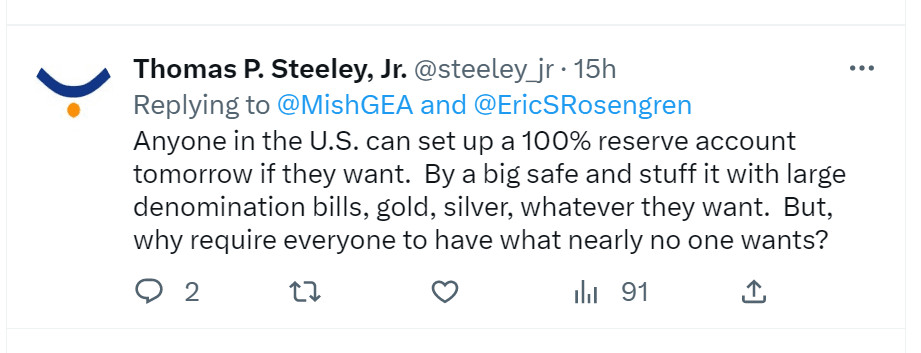

The discussion triggered a bunch of silly responses on Twitter but this one takes the cake for financial illiteracy.

Mattress Solution

"Anyone in the U.S. can set up a 100% reserve account tomorrow if they want. By a big safe and stuff it with large denomination bills, gold, silver, whatever they want. But, why require everyone to have what nearly no one wants?"

Wow!

Try making a $1 million payroll out a safe or a mattress.

Heck, try paying for anything with $10,000 in cash. You will have a quick knock on the door wondering where you got the money and more than likely it will be confiscated as drug money.

As for "But, why require everyone to have what nearly no one wants," it seems to me that there was a run on SVB to the tune of hundreds of billions of dollars because there was amazing demand for a safekeeping bank.

FDIC only covers $250,000. The bank run happened precisely because there was no safekeeping by the bank.

Not Designed for Speed

"The supervisory process has not evolved for rapid decision making. It is focused on consistency over speed. In a fast-moving situation, the system is not as well-designed to force change quickly."

Not Designed for Speed

Here's another hoot from the same article.

"The supervisory process has not evolved for rapid decision making. It is focused on consistency over speed. In a fast-moving situation, the system is not as well-designed to force change quickly."

Again, this has nothing to do with speed. It has everything to do with a zero reserve requirement on deposits plus a Fed that crammed about $9 trillion in deposits down banks throats while ignoring duration mismatch of bank investments of those funds.

We do have consistency, that's for sure. We have consistency of doubling down on failed policies and not learning from past mistakes.

Fed Policy: It's Not Fractional Reserve Banking, It's ZERO Reserve Banking

If you think we have fractional reserve banking, we don't. We have zero reserve banking.

For further discussion, please see Fed Policy: It's Not Fractional Reserve Banking, It's ZERO Reserve Banking

Part of my proposal is admittedly controversial. I propose a 100% gold-backed dollar. But we do not even have a 100% dollar-backed dollar.

It is directly responsible for the standard of living, technology and medical care you enjoy today.

All SVB or any bank had to do to maintain 100% liquidity was park deposits at the Fed or in extremely short duration US Treasuries.

Reader Question

My posts also triggered this question. "Are you proposing that banks stop making loans from their deposits?"

This is a failure of SVB, the FDIC, reserve policy, QE, and the Fed.

I blame the Fed the most.- Mike "Mish" Shedlock (@MishGEA) March 25, 2023

The fact of the matter is loans create deposits. And so did QE to the tune of nearly $9 trillion.

Fictional Reserve Lending

If anyone thinks I am a johnny-come-after-the-fact-lately I have written about the problem many times, at least once in 2009 an again in 2020.

Please consider my March 2020 article Fictional Reserve Lending Is the New Official Policy

Official policy finally caught up with reality. Reserves are fictional.With little fanfare or media coverage, the Fed made this Announcement on Reserves: "On March 15, 2020, the Board reduced reserve requirement ratios to zero percent effective March 26, 2020. This action eliminated reserve requirements for all depository institutions."

What's Changed Regarding Lending?

Essentially, nothing.

The announcement just officially admitted the denominator on reserves is zero.

There are no reserve lending constraints (but practically speaking, there never were).

When Do Banks Make Loans?

- They meet capital requirements

- They believe they have a creditworthy borrower

- Creditworthy borrowers want to borrow

BIS Working Papers No 292 Unconventional Monetary

In 2009, I referred to BIS Working Papers No 292 Unconventional Monetary

The article addresses two fallacies

Proposition #1: an expansion of bank reserves endows banks with additional resources to extend loans

Proposition #2: There is something uniquely inflationary about bank reserves financing

From the BIS

The underlying premise of the first proposition is that bank reserves are needed for banks to make loans. An extreme version of this view is the text-book notion of a stable money multiplier.In fact, the level of reserves hardly figures in banks' lending decisions. The amount of credit outstanding is determined by banks' willingness to supply loans, based on perceived risk-return trade-offs, and by the demand for those loans.

The main exogenous constraint on the expansion of credit is minimum capital requirements.

The central bank has a monopoly over interest rate policy, but not over balance sheet policy. This raises tricky questions about coordination, operational independence and division of responsibilities.

Balance sheet policies can have a significant impact on the financial risks absorbed by the central bank. The extent depends on their characteristics and on how much they are relied upon. This, too, raises questions about operational autonomy and credibility, largely reflecting the impact of losses on the financial position of the central bank.

Read those points over and over until they sink in. I discussed that article in 2009 and again in 2020.

Three Key Points

- Deposits result from loans and QE policy.

- The central bank has a monopoly over interest rate policy, but not over balance sheet policy. The FDIC is supposed to address the latter. And in the case of SVB, the San Francisco Fed was also asleep at the wheel.

- Social media, smart phones, and the WSJ notion "The Economy Changed, Regulators Didn't" are scapegoats to a problem I addressed in 2009.

What to Expect

Banking regulators will spend months, if not years, getting to the bottom of what happened.

They will conclude the problems are social media, smart phones, and the WSJ notion that the economy changed but regulators failed to keep up.

This post originated on MishTalk.Com.