Privatizing the Republic: Trump's Plan to Sell Off the State and Enclose the Future

March 20, 2025

The Quarterly Q&A with our Patreon Supporters

Episode #15

KARL FITZGERALD: Welcome everyone to another Patreon Q&A session with Michael and his beloved Patreon supporters. We're with Michael Hudson, renowned author, Wall Street analyst, and seer of modern times. Michael, I wanted to sort of frame this conversation. I love reading Substack and I'm all fired up today after Trump's big speech. And more particularly, I wanted you to delve into Project 2025. Can you tell us how you've seen this developing over the years, over the decades, and any insights you may have on the Heritage Foundation? What is the real big picture behind Project 2025?

MICHAEL HUDSON: Well, I can see from what Mr. Musk is doing and what Trump talked about that he has two ideals that he wants the American economy and the European economy to be like. The first is Margaret Thatcher. He wants, he says, 'we want to get rid of the government. We want to get rid of the state. We want a centrally planned economy. The planning should be by the people that you see right around me, the billionaires of the financial sector.'

The second ideal he has (of course, he needs a team to do this) is what the neoliberals did in Russia after 1991. What Trump wants to do, and what his commerce secretary announced yesterday they want to do, is to take all of the government property and put it into private hands where it can be used to make a profit. Well, what they really mean is economic rent because there's a reason why government property and enterprises are public and not private. And that's because almost all of the government enterprises and government agencies are natural monopolies, like the post office, which now, of course, isn't so much anymore. It's being undercut. Communications, transportation, all of these things that if you look at a century ago in Europe and other countries, all of these things were basically public and were provided for free, like health care or education. And these were conservative policies.

And there were conservative policies such as Benjamin Disraeli in England, who, as I've said before, said health, health is all. And the reason that the government took them over was that the employers were not going to pay their wage earners high enough wages to pay for their own health care, or pay for their own education, or pay monopoly prices for the buses and transportation and railroads and later airplanes they have to take, or for communications, telephone service, or for gas and electricity and water. The government taxed the wealthiest people, which was the original American income tax, and it fell on 2% of the population, mainly the landlords and the bankers and the monopolists.

Trump would like to make all of America look like Thames Water in England. You know, here's a company that began with no debt at all and was given to a privatizer at a low price. They created billions of dollars of wealth for the stockholders by just borrowing money and paying what they borrowed from the banks out as dividends. They keep raising the price and saying: Well, we have to raise the price that we sell you water for because we're paying so much interest to the banks for the money that we paid to buy our stock, to push up the stock price, and to pay special dividends to the private capital owners of Thames Water.

Trump says this is what we need to do for the United States. Here's a wonderful thing about tariffs that we want to change our tax policy around. America didn't have an income tax until 1913. And the way that the government funded its activities over and above what it could raise in taxes was by the tariffs. And Trump said the wonderful thing about tariffs is that billionaires don't have to pay them. The bankers don't have to pay them. Bondholders in the financial sector and landlords don't have to pay them.

Tariffs fall entirely on industry and on the consumers and the employees that they have. And so tariffs can free the American economy from having to have an income tax, at least on the upper brackets, such as they pay after they get all of the special tax benefits and deductibilities, such as depreciation that we've discussed before. So, essentially, Trump wants to get rid of the mixed economy and have only a one-sector economy, only the private sector.

His Congress Department Secretary came out yesterday and said, let's change the way we report gross domestic product. We know that with tariffs, there are going to be supply interruptions. We know that what we're doing is going to throw a lot of people out of work, starting with all the government people that we've just fired. And so that means that GDP will go down. So let's have two parts of the GDP.

One will be the private sector GDP, and the other will be the government sector. So that when the government sector shrinks as a proportion of GDP, you don't want the newspapers to come out with the headline, America's GDP falls 5%. The Trump administration and the Commerce Department said we will focus on the private sector element of GDP, because what they said is the government doesn't produce any service people want. There's nothing that it does that's productive. Productive means making a profit. And that's because the government isn't supposed to make a profit when it provides emergency service like health care or research or National Endowment of Health.

Well, I admit that they've done an awful job with COVID, but there are various reasons that governments throughout the world have created all these public agencies. And the Trump team, the cabinet, says, let's just get rid of all the government agencies now. They can be given away. They can all be privatized. And if you look at the people, the Silicon Valley people around Trump, the billionaires who've contributed so much to his campaign, Mr. Musk himself, who's doing all the cutting, you can see that what they know, and.....

... what a lot of people don't realize, is that most great fortunes in history have been made by privatizing the public domain. Most of the great landlords came by the enclosure movement in England in the 16th and 17th century, just enclosing the land. As Balzac said, most fortunes stem from some long-forgotten theft that is viewed as, well, somehow the family's wealth has been around so many centuries that it's all been interwoven into just the way the world works.

And Trump realizes that, well, if all the great fortunes of the European aristocracy, the wealthy families of the past, have all come from appropriating the public domain, we can do it all over again in America. We can do for America what Russia did for the kleptocrats that created so many more billionaires. That basically is the free market plan that you referred to, Karl. And by a free market, they mean one that is not run by government subsidy, but is run for profit. And the profit motive, meaning the economic rent motive, because all of these are monopolies, will be to make the entire economy look like Thames Water in England, or you can pick your analogy in almost any other country, Gasgrom in Russia, Autovox, whatever. So that's the plan. And that's why this is not only a domestic war.

I think Trump has said, well, you know, this plan to remake the economy is not only the American economy, it's the worldwide economy. And don't think of our enemy as Russia. Our enemy is wage earners and the government sector. And so we're going to back similar parties in Europe. The Alternative for Deutschland is a far-right party. In Italy, it used to be called fascism. But Mussolini said, really, you shouldn't call it fascism. You should call it corporatism. It's the corporate state where what used to be the state, what used to be a government that was run by elected representatives, will now be run by the corporations.

And the problem is that elected representatives don't want these government agencies to make a profit or a monopoly rent. They're actually providing services that are very essential, for less than they could charge people. For Trump, as for the Fascists, if they're essential services like health care, water, electricity, they're that essential, then we can just raise the price and make these into money-making, profit, and rent-generating enterprises. And that's really what economic growth is all about - according to the 'libertarians'.

KARL FITZGERALD: And so, really, we've just got neoliberalism on steroids. And I wonder if with Project 2025 and these policies, they are sort of making it so obvious now. Are they actually doing us a favor in awakening people to what neoliberalism has been doing quite subtly for, well, not subtly, but forcefully for, 20, 30-odd years? The privatization agenda.

MICHAEL HUDSON: Well, it's working. I mean, you saw that Alternative for Deutschland is the second-largest vote getter, 20% of the vote in the recent elections. Whereas the left-wing, Sarah Wagenknecht's party, the real left-wing party, and there's only one, Sarah Wagenknecht's, got just under 5%, 4.9 plus percent, not enough to get into parliament. There is her former party that she broke from, the Linka, the left party, which is basically also like the Social Democrats, a neoliberal party.

There's no party that is what the left used to be like, which is supporting rising living standards for labor or consumers or wage earners; however, you want to characterize them. It's all about how do you create profit opportunities that are going to increase the stock market and the bond market and the real estate market. And the problem is that the stock and bond markets are held almost entirely by the wealthiest 10% of the population.

So the part of the economy that is going to be raised is the economy of the wealthiest 10% and especially the 1% and overwhelmingly the 0.1%. Those are the people who are grouped around Trump now, and they're making their move. And in America, that's unchecked because of the Citizens United ruling here that essentially lets elections be bought by the donor class and campaign contributors.

Then you have Elon Musk giving $200 million to the party that appointed him to begin cutting down government and ending it so that the huge swaths of government buildings are going to be sold off. And that will include courthouses and almost everything. Are they going to gentrify them? Are there going to be so many billionaires' families that they're going to be able to move into all of these luxury apartments that are made by the sell-off of government buildings and other public buildings?

And also, the national parks are being talked about being sold off. The Park Service employees have been slashed. I think something like 50% of the guides and the workers and employees who are supposed to take care of the gardening, the presentation, the vegetation, protection against fire - all of these people are basically fired. They'll have to find new jobs. And the government apparently doesn't want unemployment rates to go up.

They're not going to be able to collect unemployment, especially if they're told, "If you resign now, we won't have to fire you." We'll give you something, but nobody knows what that something is. And when you're given a promise by Donald Trump to give you something, you know that from experience that people who've been promised very rarely get what they've been promised. And it looks like what's in store for a lot of American former government workers is the need to find a new job. And that means finding a new city to live in, not Washington, D.C., not the big cities that are centers of mainly government employment.

Santa Fe, New Mexico, is a city with very heavy federal employment. Kansas City is a city with very heavy federal buildings. Chicago, again. All of these cities where there's already an oversupply of office real estate are now going to get a lot more. So you're going to have all of this government property of various forms, from parks to various enterprises run by the government, to buildings. All of this is going to be thrown onto the open market at prices that can best be afforded by the private capital agglomerations that have been developing in the last few years. So you're going to have a whole change in the ownership pattern of the American economy.

And the U.S. is trying to push similar right-wing parties all over the world wherever it can. Just today on Johnson's Russia list, there are reports of what the administration is doing to replace Zelensky. Well, Trump's people are over there in Kiev interviewing the former kleptocrats, Tymoshenko and the chocolate king there.

They think: what kleptocrat are we going to pick who's going to pledge to promote a similar kleptocratic policy to what made Ukraine the country that it is, and what made Russia the country it was in the 1990s under Yeltsin? They're looking for a Ukrainian leader who will be the closest approximation to Yeltsin or Zelensky. And we're dealing with a movement, I won't say it's worldwide because it's really limited to the West and to the 15% of the world's population. But it looks like it gives new meaning to the decline of the West.

KARL FITZGERALD: Michael, you're answering this very calmly. Hopefully, we can say something to really fire you up today. But good to see the Patreon supporters here. If you can put your QA question and your questions in the QA panel, that would be good. I am going to read a webinar chat here from Rezwan Rezani that's related to this theme. And he says, the thing about Project 2025 is how systematic and organized it is and how they've been building up to this with an intense network of churches and NGOs that echo the talking points. My mom was the recipient of a flood of regular mailings telling her how important it is to support these goals. And they have such a strident shorthand. Do we have anything similar to counter that juggernaut?

MICHAEL HUDSON: No, that's what's so striking. There's really nothing like what used to be the socialist parties or the left-wing parties. They've been so co-opted by the non-government organizations that have given grants to members of these parties, who are sort of like Starmer or Tony Blair in England. They're looking; every country has people on the left, and every party has a bell-shaped curve. And you have people who are idealists, you have pragmatic people, you have opportunists, and the non-governmental network of organizations is able to act as a talent scout for these people. And they can find the Kier Starmers or the Tony Blairs or the Macrons and give them promotions and find lesser models for them to staff the prestigious non-governmental organizations. Well, of course, that's what Trump has said the National Endowment for Democracy has been doing, putting the neocons in favored positions.

I think what they want to do is not so much oppose non-government organizations itself, but to create perhaps privately funded organizations like the Heritage Foundation, the foundations, the Cato Institute, and the foundations that are supported by the wealthy class or the two brothers. I'm blocking out the names right now, but the right wing. And so they've been able to nurture them for many years.

It's very much like Operation Gladio that the CIA organized in Italy to isolate any real left-wingers from the political scene and replace them with a kind of zombie-like pro-American smoothies, politicians who could use the right rhetoric, sort of someone like Obama, who could speak as if he's in favor of democracy and actually in practice supporting his elite class, the neoliberal class, and the banking class. So there's been this "poisoning the swamp" for the last 50 years or so, maybe 75 years, I guess you could say, in international politics, mainly by the United States, and now also funded by other groups: Germany, England, and France. That's really what we're seeing.

And the political spectrum is no longer right and left in the sense that it used to be in the early 20th century and late 19th century. The terms left and right have no more meaning now that the left has been more neoliberal than the conservatives. And Tony Blair was to the right of Margaret Thatcher and did things that Thatcher never could have done, like privatizing the railways, privatizing things that would have been unthinkable and could only have been done by a nominally Labor Party or nominally Social Democratic Party, sort of like Nixon goes to China. Only somebody who'd been using the rhetoric of their party that all of its history was opposing privatization and kleptocracy and rent-seeking could actually come out and say, well, we're going to promote it all. Hey we've been able to capture their voters and convince their voters to "look at what we say we're going to do instead of what we're actually trying to do."

You have the media as part of this system, and what Trump has said was, well, a lot of the National Endowment for Democracy money has gone to the media. I think he mentioned a number of press services like Reuters; that's been getting money and various other media. I guess that must mean the New York Times, the Washington Post, or the papers throughout Europe that used to be considered left-wing papers like The Guardian are now neocons, at least when it comes to Russia. So you're having a combination of politics, the media, and even economic theory, academic economics.

There's nowhere [in the media] where we can put the kinds of things that we've been discussing on Patreon and that I've been writing about and doing my interviews about. There's no way that you can get this kind of discussion into the public press, at least the main public press. And you're not going to get them into universities either right now. So, the question is, how are people even going to know that there is an alternative? The whole idea of the right-wing, the neoliberals, and the libertarians is there is no alternative. And if they can somehow repress any knowledge that there used to be an alternative, and there is an alternative, if they can marginalize that and isolate it, then you've got enough of the population to make it quiescent and willing to go along with whatever you've planned for it.

KARL FITZGERALD: Patty Lynn asks, "What are your thoughts on the recent one-day boycott? Do you recommend labor strikes instead? Do you think financialization and outsourced labor make our collective power to strike less effective?"

MICHAEL HUDSON: Well, that just means you're going to buy your groceries tomorrow. I mean, if it's buying, that's pretty not focused. There's used to be a phrase: he who underlines everything, underlines nothing. And I guess we don't go shopping every day. I don't think we went to the store today. Were we part of a boycott? Not consciously, but we don't need to shop every day. Sure, we can; there are days of the week that we shop more. So I'm not sure what the boycott really means. A boycott means it's not one day. You target a given objective and that's what you target. It's not a one-day thing. So I'm not impressed with a one-day boycott. There has to be a particular thing that you're boycotting that is longer than 24 hours.

KARL FITZGERALD: Virginia, our host here from the Real Progressives, asked, Michael, if you can clarify, the federal government doesn't really need income tax or borrowing, at least not in the US, UK, Australia, Japan. Can you answer that from an MMT perspective?

MICHAEL HUDSON: Well, every government needs taxes because that's what gives money. When government prints money, how does it give value to money? Well, ever since the third millennium in Mesopotamia and Egypt, the government gives money value and gives value to whatever it designates as money, whether it's silver or grain or gold or paper currency. It accepts this money in payment for taxes so that there's always a use for it. Otherwise, you just print it and it's out there. And what do you do with it? I think Hyman Minsky said anybody can print money. The problem is, how do you get it accepted?

Well, general purpose money that is used for anything is money; ultimately, that can be spent on services from the government or paying taxes from the government. Now, of course, there are other kinds of money. Look in the 16th and 17th centuries, banks used letters of credit. And while government bonds and other government debt were selling at a discount, the mercantile claims on each other, financing imports and exports (it used to be called the real bills doctrine), that could be money, but it was only used by merchants. So governments need to tax. I think what Virginia meant to say is governments do not need to borrow to finance their budget deficits. They can finance their government deficits by doing what banks do and creating money.

The difference is that banks create money by lending it into the economy, and the government creates money by spending it into the economy on goods and services. And that spending it into the economy adds to economic activity. Whereas when banks create money by making a loan, then that creates debt on which interest is charged. And gradually this growing debt and its carrying charges eat into the economy, siphoning off more and more revenue from being spent within the economy. And that's why the government's money creation is so much more productive than commercial bank money creation. I think that's basically the difference.

VIRGINIA COTTS: Is there, may I just intervene?

Because earlier you were talking about income tax and supporting services like social security, l, like the post office, I think you used as an example. And I just want to clarify that at least since we've been off the gold standard, the government hasn't needed to tax for those things.

Taxes serve the purpose that you were just talking about, driving the value of the currency and the need for the currency.

MICHAEL HUDSON: I mean, so the question then is: what's going to give money, give value to money once Trump says, well, we won't have an income tax anymore, or we'll only tax the bottom 50% of the American population, not the top 50% or whatever. Can you say that, well, the value of money is going to be being used to pay tariffs to import the goods and services that we need? I guess you could say that in part, but basically, the ideal [in Trump's policy] is not to have government money at all.

The money that will be created, will be created entirely by Wall Street and by commercial banks. And that money will be essentially taking the form of loans, collateralized by real property, like a house or commercial property or a stock in a bond, something that the banks would like to foreclose upon. So that's essentially the kind of money that the Trump administration wants.

You had this argument after the Civil War. You had governments blocking governments, you had the British government forbidding the American colonies in the 18th century from printing their own money. And the idea was if you don't let the colonies print money, they'll have to get money in the form of coinage or loans from the British creditors that come over. The bankers wanted to keep the economy reliant on having to go to them for the money. Same thing in the early 19th century, President Jackson and his vice president Van Buren declared war on the Bank of the United States, saying we don't want a moneyed oligarchy to develop.

Well, Van Buren called the moneyed interest and essentially wanted to get rid of them. And the great quantum leap, way beyond what the American colonies did, was the Civil War. And in the Civil War, the American government did what the European governments had to do in World War I. It had to print the money in order to provide the economy with enough circulating medium to fight the war and defeat the South and hold the Union together. Well, it was pretty widely understood and agreed with. This was an emergency condition because it was a war condition, and there wasn't enough gold and silver around to finance the war. And in fact, there wasn't enough private credit to finance the war.

But when the war was over, the bankers said, well, now you've got to go back to gold, not only go back to gold standard as a means of backing for the money, but you've got to go back to gold at the old pre-war price. You've got to reduce wages and prices to a fraction of what they are now so that we creditors, who have debt claims on borrowers, the money that we've lent will have the same power over labor and goods and services that we had before the war.

Well, that led to three decades of arguments saying, well, the bankers are our enemies. There was the whole fight over the deflation that was forced by the bankers, convincing the government that the real money can only be either bullion, silver, and gold that was a pure asset with no debt, or bank credit. Well, you ended up with Williams Jennings Bryan saying, well, this is crucifying the farmers and the rest of the population on a cross of gold. And there was a real fight.

The banks became very worried about this because you had monetary reformers and socialists saying, "Why don't we make money in banking a public utility? Why don't we socialize money and have the government print it? If banks can create money just by printing it, why can't the government create money by printing it?" And the fact that America was so successful during the Civil War and being able to print its own money, the greenbacks, to finance it all, sent shivers of fear throughout the banking class.

And right after the 1907 crash in the United States, the wealthiest bankers, J.P. Morgan and his crowd, got together and said, we've got to take all the power away from the Treasury Department. We've got to take it away from Washington. We've got to make sure that there's never going to be the public and Congress and voters in charge of what money will be created for and what it will be spent on. So they designed the Federal Reserve. And the Federal Reserve took monetary policy and money creation out of the hands of Washington and put it in the hands of the money centers, mainly New York City, but also Boston, Philadelphia, and the Chicago Mercantile Exchange there. And there was not even a government official, such as the Secretary of the Treasury, on the board of the Federal Reserve. It was completely privatized.

This is, I think, part of the utopian Gilded Age that Donald Trump is hoping to make America great again to restore. So you've had this argument over what kind of money are you going to have? Is it going to be just hard money, gold and silver coinage? Is it going to be bank money created by creating debt and lending it out? Or is it going to be government money spent?

These are the three kinds of money, and each of these three kinds of money benefits a particular part of the population. Coinage and bank money benefit the creditor class. Government money benefits labor and industry, which is the indebted economy at large. So I think you should look at when people talk about what kind of money are you going to have. Well, you should always ask who benefits? Is it the creditor class or the debtors of the economy at large?

KARL FITZGERALD: Thank you, Michael. Feels like there was a bit of an insight into your upcoming new book there. Yeah, beautiful. Virginia responded: seize the means of production of money.

And Andre asks, in Canada, they are parachuting Mark Carney, a U.S. banker, on us, a greenbacker, banker. What is he going to get us to accept to put us more into debt? He's really worried.

MICHAEL HUDSON: I'm not aware of what's happening in Canada. The Bank of Canada used to be great back in the 50s and 60s, but that was a different epoch. That was before the Liberals took over. So I don't know what's happening these days in Canada. But once it comes to 51st state, of course, I'll follow it.

KARL FITZGERALD: Michelle asks, Michael, first, thanks so much for continuing to educate people and taking your time to help us understand how it all really works. You stated the difference between commercial banks and savings banks, and you further stated this would decentralize power and help small business. Can you be explicit at how this helps small business?

MICHAEL HUDSON: Well, most people think of banking as what savings banks do. Savings banks, and I used to be the economist for the central bank for the savings banks, a commercial bank. So I worked with them for years. The savings banks can only lend out money that they have on deposits. And they used to be, like savings and loans, required by law to limit what they could lend out. And it was mainly real estate. So their loans were to real estate, initially, mainly to small families.

That's why, in New York, if you look at who, what were the big savings banks? The Bowery Savings Bank, the Immigrants Savings Bank, and the Dime Savings Bank. These were savings for small depositors. And the idea was that small depositors would make interest there, and the interest would mount up, and the banks would have more money to lend out for mortgages to the class of people who were their depositors.

Well, by the time I joined the savings banks trust company in 1962, the bankers had already sort of forgotten their social obligation of savings banks, and they just wanted to make as much money as they could. Their thinking was: we can make more money lending to Florida than lending to New York State. So let us lend to other states. We don't want to lend to our depositors. We want to lend to whoever gives us the most money. And then they said, we want to lend to commercial developers also. And they did.

Then finally, under, I think it was under Alan Greenspan, after the savings and loan crisis, the commercial banks came up and said, well, let's give the banks more money to lend. Let us merge and buy them out. And so the commercial banks bought the savings banks and emptied out all of the consumer savings that was supposed to be the capital stock. They're like the securities, the stock that the depositors had, and they gave them to themselves.

And then they, being commercial banks, didn't have to be limited to how much their deposits were because, as a commercial banker, somebody could go into the bank and say, you know, can we make a loan to buy another company or to buy an office building or whatever. They could just create the money and say, okay, sign this. We'll credit you with a deposit. So you'll have the deposit and we'll have your IOU.

I suspect what Virginia was asking, what the question we just talked about wasn't about savings banks, it was about community banks. And community banks functioned like commercial banks. I was also a consultant to one of the community banks in Chicago. And they were supposed to give loans to bankers in their neighborhood or community, however you described it, whether it was a geographic community or however you define the community. But I went to Chicago, I think this must have been just before the 2008 crisis. And the bank president said, "Well, you know, we have a real problem. We have to make money for our stockholders. And we're making money in the same way that the commercial banks are making money, recklessly. We're making reckless real estate deals for operators to come in, and buy an apartment building."

You try to kick out everybody. You turn an apartment building into condominiums. An apartment building, say it's a million-dollar building. You take out a million-dollar mortgage so you don't have a penny of your own money in this. You've got a building completely with bank money, and then you say, "Okay, we're going to sell you the apartments, and the price we're going to charge for the apartment is another million dollars capitalized."

People bought these condominiums and co-ops that were financialized in this way. The community banks, as well as the other banks, ended up making hundreds of millions of dollars for real estate operators like that. And that was the whole co-op and condominium scam that happened here. And so, everybody can say they're part of the community, but the real community is a community of people who want to get rich quick at other people's expense.

KARL FITZGERALD: Brutal, but true. Rezwan asks a great question that kind of brings us into the campaign front that Patty was hinting at before. How can we actually arrest this change that's going on in society? So, Rezwan says:

"So, how to get money, the money distinction conversation in the press, taking some inspiration from Grover Norquist and his mission to get every politician to sign a pledge not to raise marginal income tax rates. The pledge was just a vehicle to spark public conversation. It was also a handy way for him to raise money through an NGO creating funding and awareness. So, his question is: Could we try a parallel pledge except instead of government tax, it would target private rent-seeking and make the connection that is a sort of tax on everyone?

The goal here is to start a conversation that has a clear conceptual connection to what Grover has done to help people see rent-seeking as a sort of tax, but worse because you don't even get any services back for that. And to quantify it, the goal is simplicity, anchoring, and repetition to get a concept out there. Part of a set of parallel strategies to project 2025, Heritage et al. that both shine a light on their strategy and also instantly connect it to conceptual alternatives. I'd love to brainstorm with folks on this."

Yes, well, Reswen, so would I. That's a really important sort of campaigning prop you've put forward there, Michael. How does that stretch your thinking?

MICHAEL HUDSON: You need a time machine to do that. You need to go back to the 19th century, the 1880s, and 1890s. Everybody was talking about this at that time. That was the entire classical economic school, from the French physiocrats in the 18th century through Adam Smith, Ricardo, John Stuart Mill, Marx, Henry George in America, and the entire classical economics. Value theory was all about: we want to distinguish between value, which is the actual cost of producing something, and the price of something. And that excess price, market price, over intrinsic cost value is economic rent.

Everybody knew what this was, and that was a political issue at the time. But there was a counter-revolution. The landlords and the banking class that ended up collecting most of the rent in the form of mortgage interest fought back and said there's no such thing as economic rent. This was the anti-classical theory that Veblen sort of confusingly called the neoclassical theory, meaning the new theory that's replaced classical economics. It said there's no such thing as economic rent. Everybody makes what they earn. And if there's a price, it's because people have decided to pay it. They get utility out of whatever they're paying. And so there's no such thing as rent, no such thing as unearned income, no such thing as unearned wealth. And so that whole concept has disappeared not only from public discussion, but from the economic curriculum.

And at least when I went to school for my PhD in the 1960s, there was still a course in the history of economic thought. It was a core course, everybody had to take it. There are no such courses being taught now. It's just mathematics. Well, how do you mathematize the sort of trivia that the economic tunnel vision has become? So people are not aware of the fact that there is such a thing as economic rent that does not have to be charged.

The original idea, again from Adam Smith, the idea of a free market for the classical economists was a market free from economic rent, where you take natural monopolies into the public domain so that there won't be an opportunity to get monopoly rent. You have a land tax bringing money into the government so that as the site value of land rises, as economies get wealthier and have more and better transportation and parks and museums and schools, the government gets paid back instead of going deeper into debt.

And, of course, the desirability of having a home is the badge of being a member of the middle class, which is why the middle class in America was white, not black, because blacks were not able to get mortgages and were not able to get homes of their own normally. The middle class was basically a white and very racist concept. Well, everybody back then discussed this. So, how are you going to get this into the curriculum? Well, that's basically what I'm trying to do in my writing. I'm a classical economist. I use value and price theory to isolate economic rent and to say what you think is a product of gross national product, it's not when a landlord charges more. That rent is not a product. That's a transfer payment from the renter to the owner.

When a bank raises its interest rate charge to credit card users or to its borrowers, that payment of interest and late fees, which are larger than interest, that's not a product. That's a transfer payment from the economy. And there are monopoly rents from the private capital, privatizing a government agency and then taking an agency that was providing a basic need and saying, ah, if it's a basic need, then we've got them by the throat and we can charge whatever the market will bear. That's economic rent. But it's not really a product.

Instead of the Trump Administration's Commerce Secretary saying, 'let's get the government out of GDP', I'm trying to advocate, let's get the economic rent out of GDP. Well, in order to popularize this idea, you'd need a whole staff of statisticians and accountants to recalculate the GDP. And you can make a first approximation pretty easily from the national income and product accounts. You'll take interest, you'll take rent, and you'll estimate some form of monopoly rent. You can do it by looking at the prices of the big internet and the Silicon Valley companies. These are all monopoly rent companies, Google and the other high-tech companies are that. It used to take me a year to make a table like that.

It took me a year to do just the balance of payments of the oil industry back in 1965. It took me a year to do just the balance of payments of the United States back in 1968 and 9. And I'm spending all my time now explaining how the economy works. I'm not doing accounting anymore. I've done the accounting, which was explained to me, by taking the numbers apart. That's how I found out how the economy works. And that's something that's not taught in school.

The only way of learning it is to actually do it, and you need someone to employ you to do it. Well, I had banks employing me to do it once when banks used to do their own research. And I had Arthur Anderson do it before it was sent to jail for being a criminal enterprise and closed down. They had accounting people do it, but nobody, there's no non-governmental organization or foundation like the institutes that Karl mentioned earlier that are at all interested in financing this kind of research.

So all I can do is explain the basic principle and suggest that you study the history of economic thought, and it's all clear there. Marx wrote a wonderful history of economic thought all about rent theory in volumes 2 and 3 of Capital. And this first economic history of economic thought was actually by Marx, his theories of surplus value, which compared profit, rent, wages, and basically the returns to the various classes of society. So, all of that's been written. There's no need for me to write it again because if they're not reading it in the original, why would they want to read it in my re-explanation? So, there's just not a critical mass that is able to put this on the spectrum. I can't even find a critical mass to do this in China or Russia.

KARL FITZGERALD: We should almost have a competition for the most frivolous NGO pulling in a million dollars in donations a year because that's basically what we need: Michael mentoring a school of economists who can produce yearly reports. And then we have some heavy-hitting media professionals and some PR people writing up press releases highlighting the research, making news regularly. And yeah, we start pushing politicians to come out and talk about rent-seeking, particularly in marginal seats. We hold public forums there, and Michael speaks, asks the politicians their stance on the various privatizations going on in that community.

Then we create some political pressure, but there just isn't the sort of economic campaigning now that's around. Yeah, we've got the American Liberties Project doing good things. There are a few in that sort of anti-monopoly space, Matt Stoller, of course, but you know, it would be great to see a real campaign focus coming through on the economic front. The left does so well in health and education, but that sort of papers over the neoliberal hawks within their organizations, and that's what is so frustrating.

It would be good to have some people come up on screen. Karl Sanchez? A number of people are talking about tariffs. Can you give us the insights on your PhD that focused on the early use of tariffs and how it can help domestic economies grow? Can you give us, play the devil's advocate? Is there some sense in the tariff agenda?

MICHAEL HUDSON: Well, we know that every major industrial country of the world, starting with England under mercantilism, and then going to the United States, Germany, even France, developed their industry by subsidizing it and protecting it with tariffs. And tariffs were not only to promote industry.

The most successful application of tariffs of all was in the United States in the 1930s. President Roosevelt's Agricultural Adjustment Act that had parity pricing that supported the price of farm products high enough so that the farmers could afford to mechanize their production, to buy better seed, better seeds, to develop marketing systems, and to really develop a whole infrastructure of agriculture. And that made the United States, as I think I've said before, productivity in American agriculture exceeded that of any other industry.

Same thing with the common agricultural policy in Europe. That's what turned Europe from a food importer to a food exporter. And I guess you have the equivalent of that in Russia, not deliberately protecting its agriculture, but because the West has done it a favor in saying, look, we really want you Russians to develop in the way that we did in America and Europe. But since you don't have any economists who are familiar with how we develop, we're just going to put sanctions on you, and that's going to force you to produce your own agriculture. And the farmers, obviously, if they're going to do farming and produce crops, they have to cover their cost of production and they have to get credit to mechanize and to organize their farms. So you've seen Russia do the same thing. Well, Trump pretends that this protective tariff can be any kind of tariff.

And the whole idea of tariff policy, from Ricardo through all of the free market economists and protectionists of the 19th century, said, well, how is England going to get rich? Ricardo said, it's going to be, we want to get rich, by industry. We want other countries to buy our industrial manufactures. But we're a small island. In order to make these manufactures, we have to import food to feed our employees. And we don't want to have to depend on British landlords to produce the foods because it costs much more to produce food in Little Britain than it does in the United States and Canada and other countries. So, the key to becoming an industrial power is to import raw materials, not only food, which was the main example that Ricardo used, but raw materials, iron, and steel, copper.

We want to import the raw materials out of which manufacturers are made and then take all of our profit in the value added or rent added for the industrial products that we make out of this steel and copper and the other materials that we import. Well, Trump turns all of this inside out. He says, tariffs were wonderful back with McKinley, but he doesn't realize that he's taxing everything that McKinley and his advisors (and I wrote my book on this, America's Protectionist Takeoff), were against taxing; they said, "We don't want to tax raw materials. We don't want to try to compete with other countries to produce raw materials. We want to do what England did. We want their raw materials at a low price, and we want to protect our manufacturers to sell superior machinery and cars and all of the industrial products that made America the leading industrial country in the world by the end of World War I."

Well, Trump doesn't realize that when you increase the tariffs, as he just did specifically, on steel and on copper and on aluminum, that means everyone who makes aluminum cans to drink beer out of, that's going to go up. So the price of beer is going to go up in America because, in order to sell beer, you have to have it in an aluminum can.

Cooking utensils, anything made out of steel, is going to go up because the raw material price that now has to pay a tariff to be imported is going to be passed on all along the line, as it's made into a higher and more complex set of manufacturers. If you're going to charge for copper, then that's going to increase the cost of copper wiring. And of course, there goes the cost of electrifying a house or electrifying everything else.

Trump had the idea that somehow other countries are going to have to pay the tariff: We can impose a tariff. It'll make the American treasury so rich that we won't have to tax rich people anymore. And other countries are going to pay for it all. So it's like we're just grabbing them with rent-seeking. But there's a common price for steel and copper and aluminum all over the world. And wherever you buy it, you're going to have to buy it in a commodities market. And it's going to be the importer that pays the price for that.

Same thing with agricultural products, same things with all of the things that Trump is concentrating his tariffs on, like automobile parts from Canada and Mexico, the various parts that are put together when the cars are actually all made into a single unit in Detroit, all come from Mexico and from Canada right across the bridge in Windsor. And so, obviously, if these foreign offshoring companies that are owned by the car companies themselves, they're going to have to, the car companies are going to have to pay the tariffs, and that's going to increase the price of the car. The estimate is between $3,000 and $10,000 per car for Americans. This is not how to make American cars competitive in the world. And Trump thinks that somehow these tariffs are going to enable Volkswagen and Mercedes and other British car companies to relocate to America, but the prices are going to be much higher here because of the kind of tariff that he's putting on. So it's really crazy.

And Trump said tariffs that he's proposing will yield trillions of dollars. Well, trillions of dollars. I mean, just think of what that is. It's like it's almost as big as half the GDP. And so if you can imagine, if half the GDP is paid in tariffs by consumers, prices are going to go up, what, three or four times. You know, you're going to have $10 an egg, not $1 an egg, I guess, the equivalent. It's absolutely crazy.

KARL FITZGERALD: But is that the plan, Michael, to actually crash the economy so that, with his hands all over the controls, he can direct fire sales towards his crony capitalists?

MICHAEL HUDSON: There's no indication that that's the plan. I don't see how you're going to really benefit by crashing the economy. I think Trump is really like an eighth grader who is given a set of vocabulary words and doesn't look at what the vocabulary means and doesn't have a sense of history. None of the politicians (and even the economic academic advisors around them haven't really studied history) know anything; all they have is a vocabulary, and it's like studying the history of magic or astrology, with just not really knowing what these magical words mean and, you know, what everything is, except just slogans that you can put on. So it's somehow in their mind; all they have are slogans without any context and any concept of empirical experience. All this is theory. It's as if the whole policymaking system is autistic. Just everything is abstract and just some postmodern, I guess you'd say, a set of words. That's the problem.

KARL FITZGERALD: And when he faced such embarrassment at the Detroit Economic Club and I think the New York Economic Club, he was absolutely pasted there over tariffs, but he still stuck to it. Matt Connors asked, what is your understanding of why Trump delayed implementation of tariffs on Mexico and Canada until April? Did the automobile industry speak up? Or was it big agriculture?

MICHAEL HUDSON: Yeah, big auto said we're going to go broke. So then Trump said, okay, tell you what, we don't want you to go broke. We'll postpone the tariff for one month. You have one month to build a whole set of factories in the United States. The factories that you have in Mexico and Canada, you have one month to build a whole set of factories here. Well, it takes three or four years to build a factory, not to mention getting the local zoning approval for them. So somehow there's no sense of time. There's no sense of systems analysis. There's no sense of how you put together a... how long is all this going to be when you actually plot out what has to be done to make a factory to produce the automobile parts that are now being made in Windsor, Canada, or south of the border in Mexico.

KARL FITZGERALD: Okay, Karl Sanchez has joined us. Over to you two.

KARL SANCHEZ: Hey Michael, how are you doing?

MICHAEL HUDSON: Pretty good.

KARL SANCHEZ: Your show this morning with Richard was really good. I enjoyed it very much as usual. I do have a question for you here. We talked about the tariffs already, that was one of them. But what I'm getting at here is the Airds 2025 gig and its effect on state governments. Trump controls the federal government, but he doesn't have any control at all over the 50 other state governments. And all those governments will need to have money. They all have taxes to be paid, and so on and so forth. They have their own institutions. So what's going to happen to the federalist system with this Heritage 2025 thing? I see it breaking the federalist system into three different sectors. You have the state and locals together, then you have the federal off by itself. So there's no more three-tiered federalist system.

MICHAEL HUDSON: This is a problem all over the world, not only in the United States, but in China. That's exactly the problem in China, where China says to the localities, well, if you want to finance your public services, sell more land to the developers. Well, so they kept selling the land. Then China, the bank, would give money to the developers or to a bank that would give money to the developers to make more real estate from this land. All of this real estate bubble was simply to enable the localities and provinces to be able to finance their own budgets. Sometimes it's easier to understand a phenomenon like that when you can see it in a foreign country than to see it in your own country. But this is exactly the problem in the United States now. There used to be revenue sharing between the federal governments and the state and local governments. And now, as you just pointed out, the local governments and states are broke. What are they going to do?

Well, there are two ways they can finance their budgets. They can have an income tax, but if you have an income tax, then people who make high incomes tend to move out of state. So they have a real estate tax. This increases the real estate tax by states and localities. I pay a New York State real estate tax and New York City real estate tax together, and they're going up quite rapidly and not efficiently. There's a lot of theft by - I'm in a condominium, and the condominium company just pockets a lot of the subsidies for these taxes. It's just a disaster here. The problems that the states and cities are having in financing their budgets are driving the population out of their states and cities.

I guess, in New York City, you'd say this has the highest real estate tax of any all-around. Well, there's an enormous homeless problem here. So you have homelessness and high real estate taxes that means it has to be factored into either the cost of rent to the landlords or to the homeowner. You're having housing become unaffordable as a result of the fact that the real estate tax and income tax should be federal, not state and local, and the federal should redistribute this tax revenue to the states and localities, not only in America, but in China and every other country.

So you're having the constitutional structure of countries that were drawn up many years ago in a different kind of economic world, having the exact problem that you're pointing to. And no one's really saying, well, the solution is you federalize it and recycle the tax to the localities so that you're not going to have a war where states keep slashing their income tax to compete with other states and cities. There's a race to the bottom in the United States now among the cities and localities. And that race to the bottom makes states and cities unlivable. Nobody's saying, well, gee, the solution is bigger, more federal government. But the fact is, that's the only way to avoid this kind of a race to the bottom that you're having.

KARL SANCHEZ: What if the states were to go ahead and make their own money?

MICHAEL HUDSON: No state's making its own money because you can have a state bank like North Dakota, South Dakota, but you can't make this money spent elsewhere in the United States. So money creation has to be a national, federal creation, not a local creation. That's part of the problem.

KARL SANCHEZ: Well, if you have the state making its own money, that would be able to go ahead and pay the taxes of that state. So it would be localized to the state. And it would be a magnitude for that.

MICHAEL HUDSON: In principle, you're right, but I guess that would work in the colonial era in the 1770s and 1760s in Massachusetts. But the magnitudes at work wouldn't really work for that. I know Ellen Brown has tried to say, well, look, at least we can have the state have its own banks instead of a commercial bank. They can make their own loans to their own population and to the government. We'll take our bank, we'll pay the people to deposit there, and we'll lend that money to the government so we don't have to borrow it from outsiders. And that certainly is a help, but it's not sufficient in itself.

KARL SANCHEZ: Well, I was thinking about ways to try and combat the Heritage Foundation's plan here, their plot, which I've characterized as a leveraged buyout.

MICHAEL HUDSON: That's exactly what it is. Well, we, of course, have the Koch brothers financing them. All these foundations are funded by right-wing billionaires like the Koch brothers, or, I guess, by Silicon Valley now jumping onto the bandwagon. And you and I don't have billions to do that. And we don't even have the resources to put together a whole team to work on the projects that we write about.

All we can do is write about the principles that work, but can't work out the actual legal bit. And we can't get candidates elected. Dennis Kucinich was running for many years on the Chicago plan, essentially to have the government print its own money instead of relying on the commercial banks and the various donor class members and the Democratic Party re-gerrymandered his position to get him out in favor of the neocon Marcy Kaptur to get in. So any politician drawing something like that finds himself or herself isolated politically because there's no political party that is an umbrella organization for people supporting this kind of idea.

KARL SANCHEZ: So what do you think might act as a poison pill for this plan?

MICHAEL HUDSON: I wish I knew. Can you think of one?

KARL SANCHEZ: Well, that's why I asked you.

MICHAEL HUDSON: Ha! The plan itself is poison. So how do you poison a poison pill?

KARL SANCHEZ: I look at it and I see, well, the only thing I can see is you're going to have, we've talked about what Ukraine looks like economically, not just the war-tornness. Then there's the 90s of Russia and what happened to that economy and their social structure when it got crashed. So I'm thinking that you're just going to see something like early 1930s America.

MICHAEL HUDSON: Well, you would think that a crisis provides a nurturing environment for a solution to be voiced. But the solution can be voiced, but now you have a whole organized political phalanx, an oligarchy arrayed against such a voice to make sure that it's isolated, to misrepresent what it's taken, and to prevent it from getting access on the mass media, the respectable newspapers and television channels. So again, it's happening much easier in the global majority countries to discuss it than it is in the West.

KARL SANCHEZ: Yeah, our marginalization has been pretty complete, unfortunately.

KARL FITZGERALD: Can I jump in? If we're ever to really arrest what's going on, we have to split the right wing. We have to get small business to recognize what is going on. A lot of good people are in small business, and we know they've been crushed through globalization over the last 30-odd years. So that's where it starts and getting those classical liberals who understand the difference between price and value to really start to speak up. And the problem is, no one's providing them with any data. We need reports coming out that highlight how much this rent-seeking is hurting society. And so that's why it's so crucial we find a million bucks for Michael and his team of economic hitmen to really start peeling back to provide the chambers of commerce in local communities with the sort of information that is so crucial at this point in time.

MICHAEL HUDSON: Well, you'd think people used to be able to go to the government and get grants for this. You'd think there are so many foundations that are trying to do good work. But if the foundations are funded mainly by the billionaires, I don't think the billionaires are interested in supporting the kind of work that we're doing. And the small businesses, indeed, there may be some, I just don't know of any. I mean, we're there. All we can do is throw our bread upon the water.

If there's somebody out there that responds and thinks, well, gee, I just inherited a few million dollars. Maybe I'll give them. That's how Paul J. began now, the Real News. Somebody inherited money, and I'll just give him money to start the real news in Baltimore. Maybe it'll happen. Maybe there is a small businessman like that. I don't know. It's got to be a lot of people. I have a site, Karl has a site, you have a site, and other people here have sites. But all we can do is say what we're saying on our sites.

KARL FITZGERALD: Okay. You've got to wrap up soon. Okay. So Flo has a hand up. Come on in, Flo.

FLO SCHADE: Sure. Hi, everyone. So to take a little different turn, I guess, really great discussion today. Talking about alternatives, back to that, you know, there is no alternative in our systems and stuff here. It got me thinking, you know, this whole Doge situation, fiasco, we have some folks on the right kind of fear-mongering about all this instability is going to lead to a collapse of U.S. bond sales and treasuries. Some people have been saying that. I know, obviously, the stock market's super volatile right now.

It got me thinking, on the other hand, you know, we have leftists, at least in the MMT world, that have been arguing that, you know, bond sales are unnecessary. It's essentially a UBI to the 1%. And so you try to put those kinds of things together. And I've never really thought through what would happen if, let's say, theoretically a new government came in and stopped selling bonds tomorrow, kind of what effect that would have, given that, you know, it is so embroiled in our global economy. And is there a way to actually move away from it? Or is it going to be like a class war bloodbath either way? Or any kind of thoughts on the role of bond sales in our economy and how we could potentially think about or theorize an alternative system, like moving there from where we are today?

MICHAEL HUDSON: Well, every economy works on credit, and I don't know how you can avoid people raising money by bonds. The problem is that a lot of bonds are issued not for productive purposes at all, but for stock buybacks or for corporate takeovers, the junk bonds. Most bond issues are not invested productively.

FLO SCHADE: So it's treasury bonds specifically. I guess, sorry, I should have specified, like selling treasury bonds to raise revenue for the U.S. government, right? That model of financial.

MICHAEL HUDSON: No, if you raise treasury bonds, then you have to pay interest to bondholders.

FLO SCHADE: Well, what would happen if the U.S. government stopped doing that?

MICHAEL HUDSON: You don't have to borrow from rich people. If you borrow from rich people, you'll have the money, and then you'll print your own money. What do you need the bondholders for? You can just print the money.

FLO SCHADE: What do you think the effect on the economy would be if that happens?

MICHAEL HUDSON: What's - less interest charge?

FLO SCHADE: That's it? Like, you would be fine, aside from you think, like, the political.

MICHAEL HUDSON: Yes.

FLO SCHADE: Okay. Yes. That is good to know. So it's going to be a class war.

MICHAEL HUDSON: Money in banking should be a public utility. It should be a basic right in a way. It should not be privatized. The privatization of money in banking is what creates financial oligarchies. And if you don't want a financial oligarchy, you create money without interest. Very simple. That again was Dennis Kucinich's Chicago plan.

FLO SCHADE: Yeah, absolutely. I mean, I assume there would be a big effect on markets and, you know, arbitrage or the foreign exchange markets or no, or would that go haywire, you think?

MICHAEL HUDSON: Well, it's very hard to create money that can be spent abroad. That's the problem. You can always create money to spend in your own economy, but you can't create the money that will be accepted by Germans and Europeans and other foreigners. That's the constraint. So that you don't want to create so much money that it ends up in a balance of payments deficit that lowers the exchange rate.

FLO SCHADE: Okay, thanks, Michael.

KARL FITZGERALD: All right, so it sounds like, Michael, we need to wrap up pretty soon. Is that right? Yeah. Okay. Well, thanks, everyone, for another deep dive into Michael's incredible intellectual archive. You have some great questions, and let's hope we can find that unicorn out there that can bring some of us together to work on Michael's great work and really start campaigning for a fairer future because it's not looking good from down here in Australia. And we really feel for all of you Americans going through this. Yeah, just horrific what is coming through. But great to at least understand why this is happening thanks to Michael's great work. So I appreciate everyone's support through Patreon and we will look forward to being with you, I think, June 5th or 6th, somewhere around there. So thanks once again, and we'll see you soon.

MICHAEL HUDSON: Thanks for coming. Thanks for being on part of my Patreon list. That keeps me going.

VIRGINIA COTTS: Thanks, everyone.

KARL FITZGERALD: Right on. Good on you, Michael. See you.

Transcription and Diarization: hudsearch

Editing and Review: Roslyn Bologh

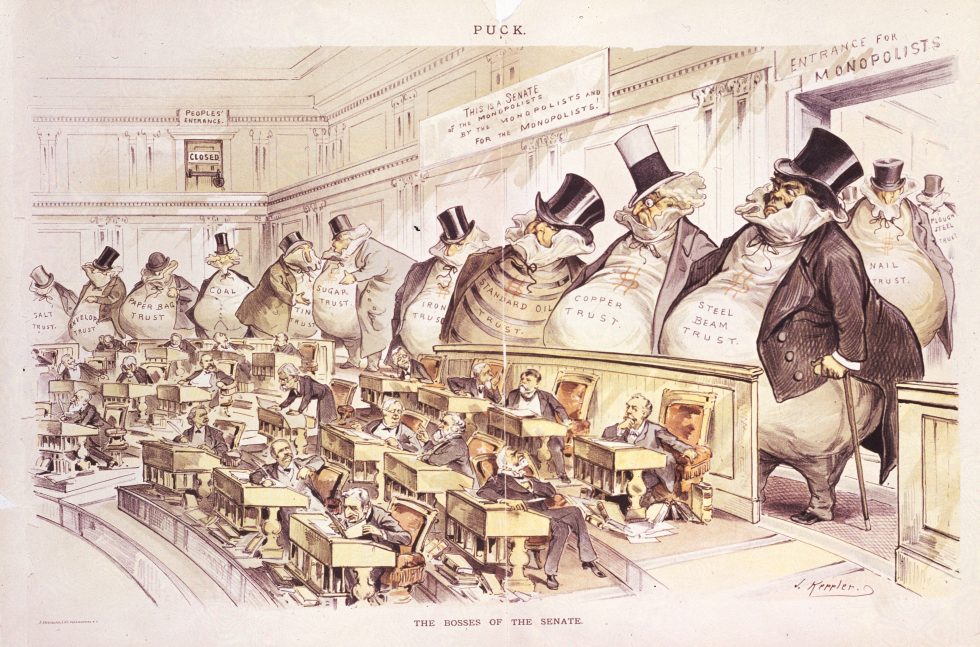

Cartoon by the great Puck, Public Domain